Today morning my Dad told me he has to visit Zirakpur’s Property Tax department to pay his property tax. He also mentioned that one of his friend will be accompanying him as he has to pay his property tax too.

I asked my Dad, can’t we pay property tax online? Do you really have to go to an office to pay the property tax? I got an answer that it’s not that straightforward to file Punjab tax online, that’s why visitng a tax office is necessary.

I told my Dad give me 30 minutes to try for online payment of property tax. To be very frank he was right, main caveat to pay online tax in Punjab is to get to the right website link for property tax payment, else you might hit the frustration wall soon.

I was fortunate enough to get to the correct link, it took me hardly more than 5 minutes to pay his property tax.

Accordingly, based on the lessons learnt, I noted all the steps to put them on a blog to help someone how is still visiting property tax office to pay his taxes 🙂

To pay property tax online you need to have the following:

- Mobile number against which your property is registered, most of the time it’s your main mobile number. For me , it was my Dad’s.

- A Credit Card – Yes, this is mandatory. You can use any credit card, yours’ or someone else’s. .

Go to https://mseva.lgpunjab.gov.in/citizen/user/login

- Add your Phone Number – (Remember – This should be the number on records of your Property Tax)

- You will receive a OTP on above phone

- Enter OTP

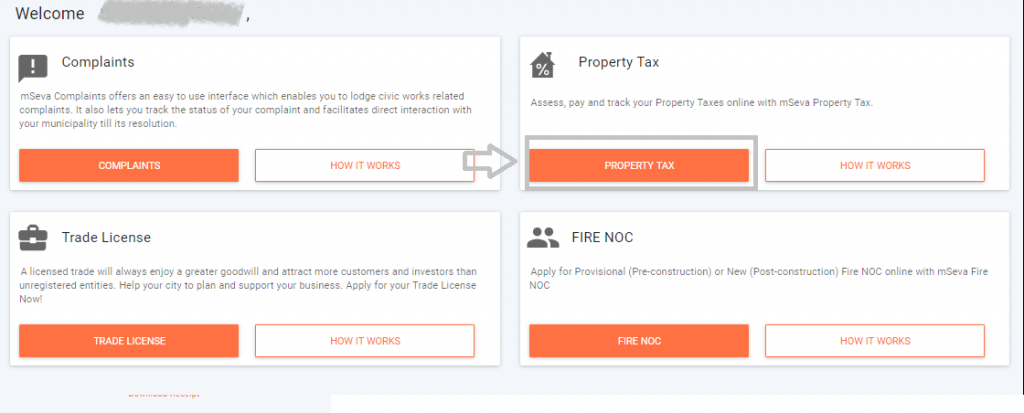

- You will come to this page

- Under Property Tax section Click Property Tax button:

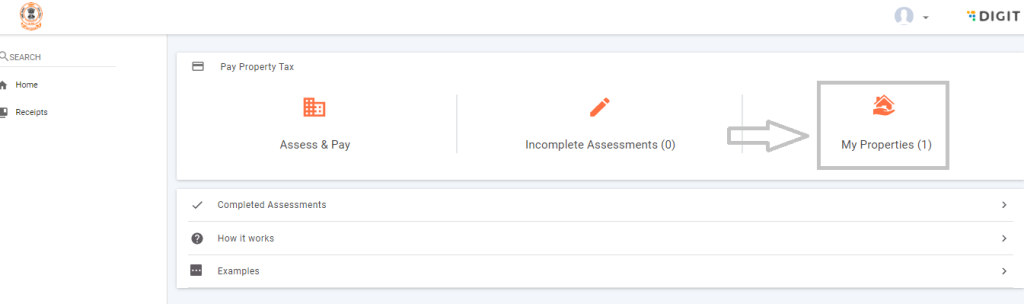

- This will bring you to below page on your screen

- Click on My Properties section on right

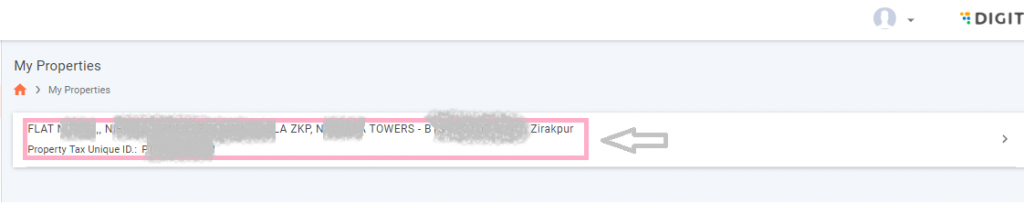

- This will bring you to below screen, this page will list your property or properties if you have more than one.

- Select/Click the property you want to pay property tax for

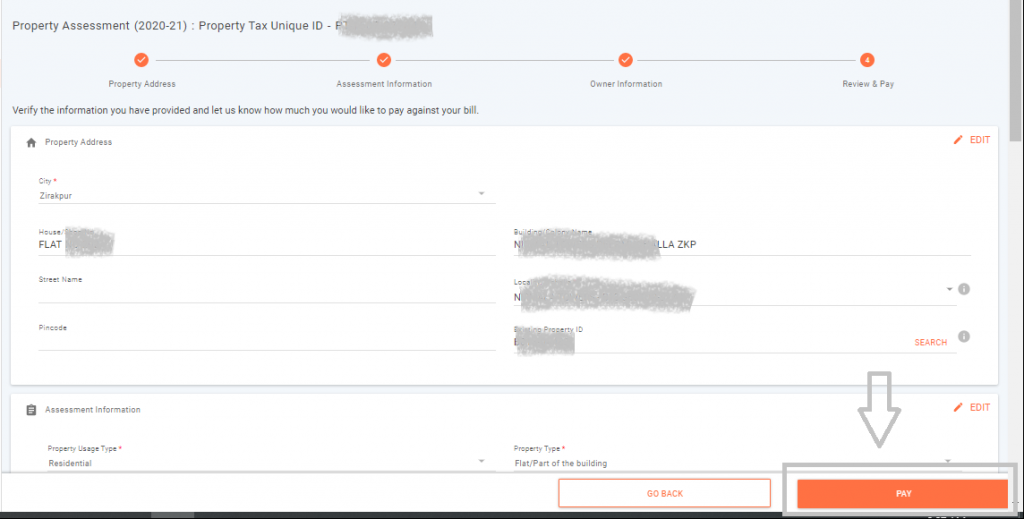

- This will bring you to below page. Look at this page to make sure all your details are correct, and you have selected correct property to pay the property tax..

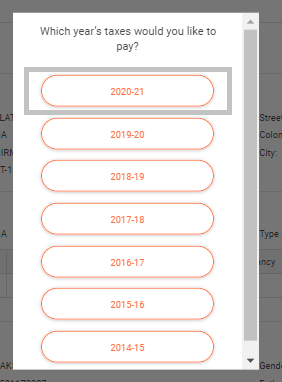

- Now Click on Access & Pay button above, this will bring up below window

- Select the year for which you want to pay the property tax. This will bring you to below page

- Check the details on above page, most all should be ok.

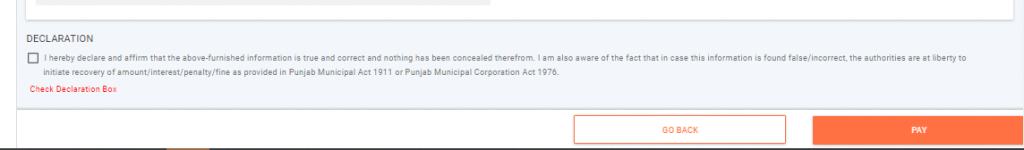

- At the bottom of this page will be a declaration section as shown below:

- Make sure to select this declaration checkbox else it won’t let you move forward.

- Then click the Pay Button.

- Now the payment page will open. Remember you need a credit card to pay the property tax.

- Enter Your

- Credit Card number

- Expiry and the

- Three digit code at the back of your credit card.

- Hit Pay.

- Now wait for few seconds payment to go through.

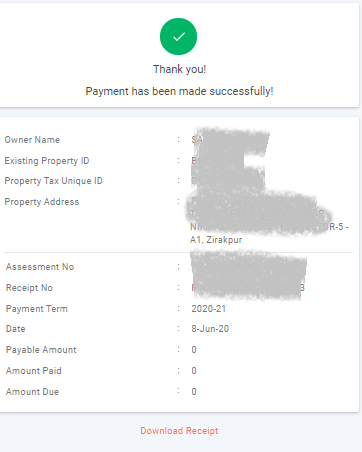

- If all goes well then you will get below “Payment has been made successfully screen.”

- Don’t forget to make a copy of above receipt, and do download the receipt as this receipt will have all the details of your property and property tax payment. Keep it safe somewhere for your records.

- This will surely save your trip to the Property Tax office

- Congratulations!!!!

I hope this information was helpful, if you have some suggestion to improve this page please do share that with me via comments below. I will surely incorporate it.

Recent Comments